Exploring the intricacies of Commercial Auto Policy: How to Avoid Coverage Gaps opens up a world of insights and strategies to ensure your business is adequately protected. Let's dive into the key components, common gaps, and tips to navigate the complex landscape of commercial auto insurance.

Understanding Commercial Auto Policy Coverage

When it comes to commercial auto insurance, understanding the coverage provided is crucial to ensure your business is adequately protected in case of an accident or other unforeseen events.

Key Components of a Commercial Auto Policy

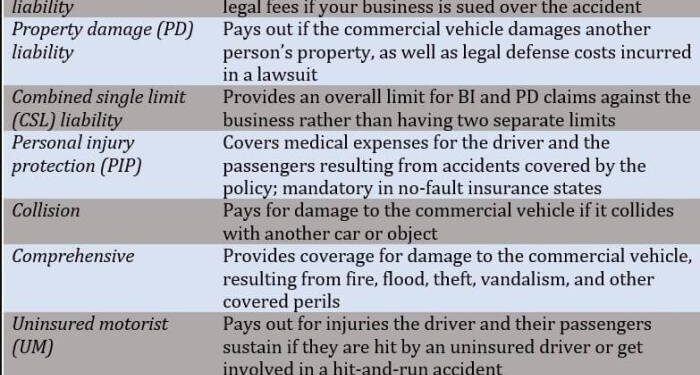

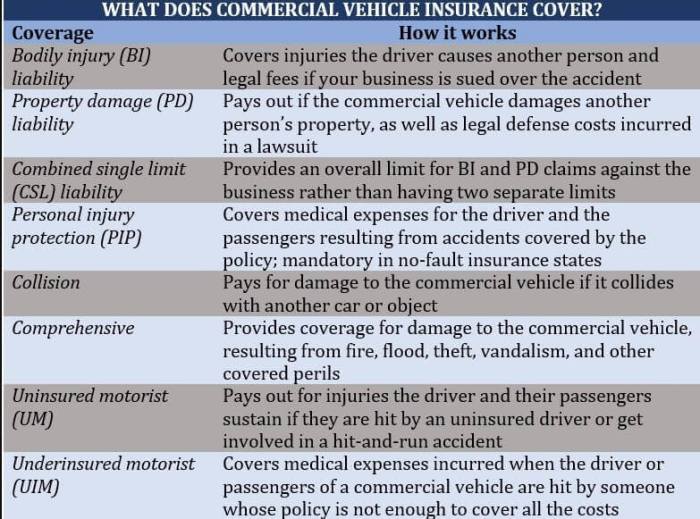

- Liability Coverage: This protects your business from financial loss if you are found liable for causing injury or property damage in an accident.

- Collision Coverage: This helps pay for repairs to your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: This covers damage to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who doesn't have insurance or enough insurance to cover your damages.

Importance of Understanding Coverage Limits and Exclusions

It is essential to review the coverage limits and exclusions in your commercial auto policy to ensure you have adequate protection. Understanding these details can help you avoid coverage gaps that could leave your business vulnerable in the event of a claim.

Identifying Common Coverage Gaps

When it comes to commercial auto insurance policies, there are several common scenarios where coverage gaps may occur, leaving a business vulnerable in case of an accident or loss. Understanding these gaps is crucial to ensuring adequate protection for your vehicles and drivers.

Inadequate Liability Coverage

- One common coverage gap is having insufficient liability coverage. This can leave your business exposed to significant financial risks if your policy limits are not high enough to cover the costs of an accident.

- Without adequate liability coverage, your business may be responsible for paying out-of-pocket for damages, medical expenses, and legal fees in case of a lawsuit.

- It's essential to review your policy limits regularly and consider increasing them to protect your business from potential liabilities.

Exclusions and Limitations

- Another common coverage gap arises from exclusions and limitations in your policy. Certain types of vehicles, drivers, or activities may not be covered under your policy, leaving you exposed to risks.

- It's important to carefully review your policy documents and understand any exclusions or limitations that may apply to your coverage.

- Consider adding endorsements or riders to fill in any gaps in coverage and ensure comprehensive protection for your business.

Underinsured or Uninsured Motorists

- Having inadequate coverage for underinsured or uninsured motorists is another common gap in commercial auto policies. If your vehicle is involved in an accident with a driver who lacks sufficient insurance, your business may end up bearing the costs.

- Adding uninsured/underinsured motorist coverage to your policy can help protect your business from financial losses in such situations.

- Ensure that you have adequate coverage in place to mitigate the risks associated with uninsured or underinsured motorists.

Tips to Avoid Coverage Gaps

When it comes to commercial auto insurance, ensuring that your policy provides adequate coverage is crucial. Here are some tips to help you avoid coverage gaps and protect your business.

Assessing Coverage Needs and Determining Policy Limits

One of the first steps in avoiding coverage gaps is to assess your business's specific needs. Consider factors such as the type of vehicles you operate, the distance they travel, and the potential risks they face. Once you have a clear understanding of your needs, work with an insurance professional to determine the appropriate policy limits that will adequately protect your business.

Checklist for Reviewing Your Commercial Auto Policy

Regularly reviewing your commercial auto policy is essential to ensure that it continues to meet your business's needs. Use the following checklist to identify any potential coverage gaps:

- Verify that all vehicles used for business purposes are listed on the policy.

- Check that the policy covers all drivers who may operate your vehicles.

- Review the coverage limits for liability, collision, and comprehensive coverage.

- Ensure that any specialized equipment or modifications to your vehicles are adequately covered.

- Confirm that your policy includes coverage for rental vehicles or temporary substitutes.

Benefits of Consulting with an Insurance Professional

While reviewing your policy on your own is important, seeking the expertise of an insurance professional can help you identify potential gaps that you may have overlooked. An insurance professional can provide valuable insights and recommendations to ensure that your commercial auto policy offers comprehensive coverage tailored to your business's needs.

Policy Endorsements and Additional Coverage Options

Policy endorsements and additional coverage options play a crucial role in filling coverage gaps and providing businesses with the protection they need. Let's explore how these options can enhance a commercial auto policy.

Policy Endorsements

Policy endorsements are modifications or additions to an insurance policy that can help customize coverage to meet specific needs. These endorsements can address unique risks or provide additional protection beyond standard policy limits.

- Increased Liability Limits

- Hired and Non-Owned Auto Coverage

- Rental Reimbursement Coverage

Additional Coverage Options

Businesses can also consider additional coverage options to enhance their commercial auto policy and ensure comprehensive protection. Here are some common additional coverage options to consider:

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

Specialized Coverage Options

Some industries or businesses may have unique risks that require specialized coverage options. Here are examples of specialized coverage options tailored for specific industries or risks:

- Cargo Insurance for transportation companies

- Roadside Assistance Coverage for delivery businesses

- Hired Auto Physical Damage Coverage for rental car companies

Last Word

In conclusion, understanding the nuances of commercial auto policy coverage and actively working to avoid coverage gaps can be crucial for safeguarding your business against unforeseen risks. By staying informed and proactive, you can ensure comprehensive protection for your vehicles and operations.

General Inquiries

What are some examples of common coverage gaps in commercial auto policies?

Common coverage gaps can include inadequate liability limits, lack of coverage for employees using personal vehicles for work purposes, and exclusions for specific types of vehicles.

How can a business assess its coverage needs for commercial auto insurance?

Businesses can assess their coverage needs by evaluating the types of vehicles they own, the frequency of vehicle use, the nature of their operations, and potential risks they face on the road.

Are there specialized coverage options available for certain industries?

Yes, some insurance providers offer specialized coverage options tailored for industries such as transportation, construction, or delivery services to address specific risks these businesses may encounter.