Embark on a journey to understand the intricacies of building a reliable commercial auto policy portfolio. From identifying essential components to discussing risk assessment strategies, this topic delves into the critical aspects of ensuring comprehensive coverage for commercial vehicles.

As we explore the significance of coverage limits, fleet management best practices, and effective claims handling, you will gain valuable insights into optimizing your insurance portfolio for success.

Components of a Reliable Commercial Auto Policy Portfolio

Commercial auto policy portfolios are essential for businesses that rely on vehicles for their operations. A reliable portfolio should include key components that provide comprehensive coverage and protection. Each component plays a crucial role in ensuring that the policy is reliable and meets the specific needs of the business.

Liability Coverage

Liability coverage is a fundamental component of a commercial auto policy portfolio. It protects the business from financial losses in case the insured vehicle is involved in an accident that causes property damage or bodily injury to others. This component is crucial in covering legal expenses, medical bills, and damages that the business may be liable for.

Physical Damage Coverage

Physical damage coverage is another important element of a commercial auto policy portfolio. This component provides protection for the insured vehicles against damages caused by collisions, theft, vandalism, or other covered perils. It ensures that the business can repair or replace their vehicles without bearing the full financial burden.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is vital in a commercial auto policy portfolio. This component safeguards the business from losses if their vehicle is involved in an accident with a driver who lacks insurance or has insufficient coverage. It helps cover medical expenses and property damage that the other party cannot afford to pay.

Medical Payments Coverage

Medical payments coverage is an essential part of a reliable commercial auto policy portfolio. This component pays for medical expenses for injuries sustained by the driver and passengers of the insured vehicle, regardless of who is at fault. It ensures that necessary medical treatment is accessible without delay.

Comprehensive Coverage

Comprehensive coverage is a key component that should be included in a commercial auto policy portfolio. This component protects the insured vehicles from damages not caused by collisions, such as theft, vandalism, fire, or natural disasters. It provides additional peace of mind and ensures that the business is protected against a wide range of risks.

Risk Assessment and Mitigation Strategies

When it comes to commercial auto policies, conducting thorough risk assessments is crucial to ensure the safety of both drivers and vehicles. By identifying potential risks and implementing effective mitigation strategies, companies can minimize liabilities and protect their assets.

Methods for Conducting Risk Assessments

One method for assessing risks in commercial auto policies is to analyze past claim data to identify common patterns or trends. This can help pinpoint areas of concern and guide decision-making when customizing policies. Additionally, conducting on-site inspections and driver training programs can provide valuable insights into potential risks and hazards.

Common Risks Associated with Commercial Vehicles

- Accidents involving multiple vehicles

- Distracted driving leading to collisions

- Damage to cargo during transportation

- Vehicle breakdowns and mechanical failures

Strategies for Mitigating Risks

Customizing commercial auto policies to include comprehensive coverage options can help mitigate risks associated with commercial vehicles. For example, adding coverage for cargo damage or rental reimbursement in case of breakdowns can provide financial protection in unforeseen circumstances. Implementing strict driver safety protocols and regular vehicle maintenance schedules are also effective strategies for minimizing risks and ensuring compliance with regulations.

Importance of Coverage Limits and Deductibles

Setting appropriate coverage limits and deductibles is crucial in determining the effectiveness and reliability of a commercial auto insurance policy. Let's delve into the significance of these factors in detail.

Setting Coverage Limits

- Coverage limits define the maximum amount an insurance company will pay for a covered claim. It is essential to assess the potential risks faced by your business to determine the appropriate coverage limits.

- Insufficient coverage limits can leave your business vulnerable to financial losses in the event of a severe accident or lawsuit. On the other hand, excessive coverage limits may result in unnecessarily high premium costs.

- By carefully evaluating your business operations, fleet size, and the value of your vehicles, you can select coverage limits that provide adequate protection without overpaying for coverage you don't need.

Impact of Deductibles

- Deductibles represent the amount a policyholder agrees to pay out of pocket before the insurance company covers the remaining costs of a claim. Higher deductibles typically result in lower premium costs, while lower deductibles lead to higher premiums.

- Choosing the right deductible amount involves balancing the upfront costs of a claim with the long-term affordability of insurance premiums. It is essential to consider your financial capabilities and risk tolerance when selecting a deductible.

- While higher deductibles can help reduce premium expenses, they may also increase the financial burden on your business in the event of a claim. Understanding the trade-offs between deductible amounts is crucial for maintaining a cost-effective and reliable insurance policy.

Comparing Coverage Limit Options

- When assessing different coverage limit options, consider factors such as the value of your vehicles, potential liability risks, and the cost of medical expenses associated with accidents.

- Higher coverage limits provide greater financial protection but come with higher premium costs. Lower coverage limits may be more affordable but could leave your business exposed to substantial losses in the event of a claim.

- It is advisable to review your coverage limits regularly and adjust them according to changes in your business operations, fleet size, and overall risk profile. By maintaining a balance between coverage limits, deductibles, and premium costs, you can ensure that your commercial auto policy remains reliable and cost-effective.

Fleet Management Best Practices

Effective fleet management is crucial for maintaining a reliable commercial auto insurance portfolio. By implementing best practices in managing a commercial vehicle fleet, businesses can reduce risks, improve safety, and ultimately enhance their insurance coverage. Adherence to safety protocols and maintenance schedules plays a significant role in ensuring the longevity and reliability of commercial auto policies.

Regular Vehicle Inspections and Maintenance

Regular vehicle inspections and maintenance are essential components of fleet management best practices. By conducting routine inspections and addressing any maintenance issues promptly, businesses can prevent potential accidents and breakdowns that could impact their insurance coverage. Maintaining a record of vehicle maintenance can also demonstrate a commitment to safety and risk management, which can be beneficial when negotiating insurance terms.

- Implement a schedule for routine vehicle inspections to identify and address any issues early on.

- Ensure that all vehicles undergo regular maintenance, including oil changes, tire rotations, and brake checks.

- Keep detailed records of all maintenance activities and repairs for each vehicle in the fleet.

Driver Training and Safety Programs

Investing in driver training and safety programs is another crucial aspect of effective fleet management. By providing drivers with proper training on safe driving practices, defensive driving techniques, and handling commercial vehicles, businesses can reduce the likelihood of accidents and insurance claims.

Safety programs can also help instill a culture of safety within the organization, leading to fewer incidents and improved insurance coverage terms.

- Offer regular training sessions for drivers on safe driving practices and compliance with traffic laws.

- Encourage drivers to participate in defensive driving courses to enhance their skills and awareness on the road.

- Establish a safety program that emphasizes the importance of following safety protocols and reporting any incidents promptly.

Utilization of Telematics Technology

Integrating telematics technology into fleet management practices can provide valuable insights into driver behavior, vehicle performance, and overall fleet efficiency. By utilizing telematics systems to track vehicle locations, monitor driving habits, and analyze data on fuel consumption and maintenance needs, businesses can optimize their fleet operations and reduce insurance risks.

Telematics data can also be used to identify areas for improvement and implement proactive measures to enhance safety and compliance.

- Invest in telematics devices that can track vehicle movements, driver behavior, and performance metrics in real-time.

- Use telematics data to identify areas of inefficiency, such as excessive idling, harsh braking, or speeding.

- Implement strategies based on telematics insights to improve driver behavior, reduce fuel consumption, and enhance fleet safety.

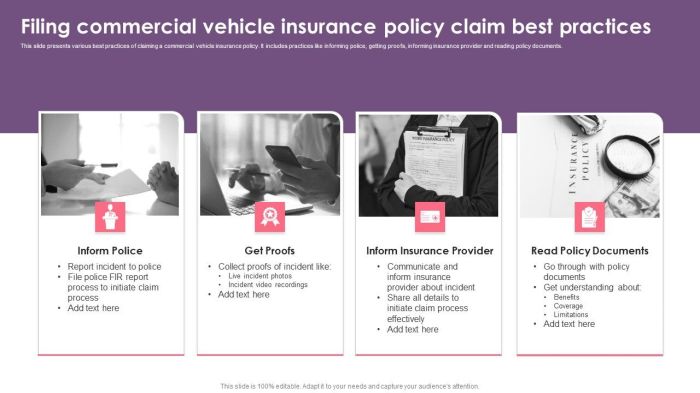

Claims Handling and Incident Response

When it comes to commercial auto insurance, handling claims and responding to incidents effectively can make a significant difference in minimizing costs and downtime for your business. In this section, we will explore the process of filing a claim, strategies for incident response, and the importance of maintaining detailed records and documentation.

Filing a Claim

- Notify your insurance provider as soon as an incident occurs to start the claims process.

- Provide all relevant details about the incident, including photos, witness statements, and police reports.

- Cooperate with the insurance adjuster to assess the damages and determine the coverage for repairs or medical expenses.

- Ensure timely submission of all required documentation to expedite the claim settlement process.

Effective Incident Response Strategies

- Implement a clear protocol for employees to follow in the event of an accident, including reporting procedures and safety measures.

- Offer training programs to drivers on defensive driving techniques and accident prevention strategies.

- Utilize telematics devices to monitor driver behavior and provide real-time feedback to improve safety on the road.

- Establish relationships with preferred repair shops and towing services to expedite vehicle repairs and minimize downtime.

Importance of Detailed Records

- Maintain accurate records of all incidents, including photos, witness statements, and police reports, to support your claim.

- Keep track of all communication with insurance adjusters, repair shops, and other parties involved in the claims process.

- Document the costs associated with the incident, such as vehicle repairs, medical expenses, and lost revenue due to downtime.

- By maintaining detailed records, you can ensure a smooth claims handling process and maximize your chances of a favorable outcome.

Closing Summary

In conclusion, the key to a reliable commercial auto policy portfolio lies in meticulous planning, strategic risk mitigation, and proactive fleet management. By implementing the discussed strategies, businesses can safeguard their assets and operations with confidence and resilience.

Detailed FAQs

What are the essential components of a commercial auto policy portfolio?

The key components include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

How do deductibles impact commercial auto policy premiums?

Higher deductibles usually result in lower premiums, but it's essential to balance the deductible amount with potential out-of-pocket costs during a claim.

What are some common risks associated with commercial vehicles?

Common risks include accidents, theft, vandalism, natural disasters, and third-party liability claims.

How can effective fleet management contribute to a reliable insurance portfolio?

Efficient fleet management practices can reduce accidents, improve driver safety, and lower insurance premiums by demonstrating proactive risk mitigation.

Why is maintaining detailed records crucial for claims handling?

Detailed records help expedite the claims process, provide evidence in case of disputes, and ensure accurate reimbursement for damages or losses.